The month-end close is no easy task. Download this free Month-End Close Checklist, modify it to fit your needs, and you’ll find your monthly close goes much more smoothly.

At the end of the month, accountants are tasked with ensuring all of the transactions for that month have been processed and are reported accurately. Users of the financial statements (business owners, bankers, investors, management, other companies, etc) rely on the financial statements to make informed decisions. It’s critical that the close process is setup to produce financial statements that are accurate and timely. Streamlined and well defined processes are at the root of a monthly close that produces the desired results.

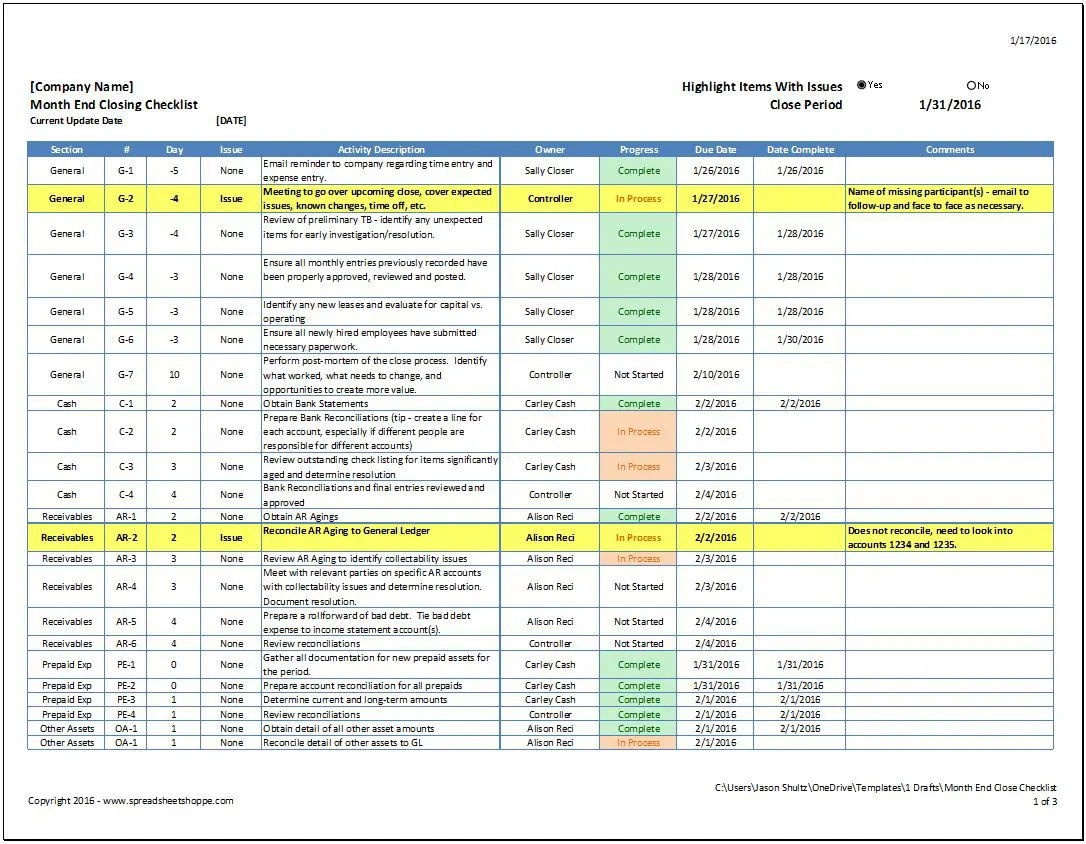

Month End Close Checklist

System Requirements & Download

What you’ll Find

In addition to the free month-end close checklist template, you will find a simple guide with information on how to use the template. We’ve also included some best practices to help generate ideas on how you can positively impact the month-end close process.

How to use the Month-End Close Checklist

General – The template comes with two tabs. The first tab “Close Checklist” is a clean version of the checklist that doesn’t have owner, progress, date complete, or comments. The first thing you will want to do is to go over the individual Sections and Activities to ensure these are the right ones for your month-end close. The activities included in this listing are not all-inclusive, and they have not been designed to meet your specific needs, goals, fact pattern, etc. So tailor them. The same holds true for timing. When tasks are performed depends in large part on staffing, goals, and technology. The overall timing as well as when specific activities are going to be performed needs to be tailored.

The second tab is an Example of an in-process month-end close checklist. This is only here to provide a visual of what it might look like during a close.

Top Section – The top portion of this template includes a location for the:

- Company Name

- Checklist Title – Default is Month End Close Checklist

- Current Date – when the checklist was last updated

- Highlight Option – select ‘Yes’ or ‘No’ to highlight items that have been flagged with an issue

- Close Period – the period being closed

This section will print at the top of each page automatically. In the header we’ve included a date field, so the date the checklist is printed will be reflected automatically.

The Checklist – We created this checklist using one of our Open Items templates as a starting place. The month-end close checklist is an excel table, giving you all of the benefits of a table with no macros. It will automatically expand to include a new record. Formatting is automatically applied to new information. The headers are always visible. Plus, it’s quick and easy to change the look and feel of the table; simply click anywhere on the table and go to DESIGN under TABLE TOOLS, then just select the color scheme of your preference.

Tool tips have been placed on each column heading to act as reminders for the contents of each column. To change these, or delete them, select the cell with the tip you want to modify. Then go to DATA > DATA VALIDATION > INPUT MESSAGE.

- Section – Categorize the tasks/activities into Sections. Tip, make the Sections conform to the financial statement lines for your business. Sections can also include reporting tasks and other project management objectives relevant to the month-end close.

- Day – Enter the number of days before (as negative numbers) or after (as positive numbers) the end of the month. For example, if a task is supposed to occur 2 days before month-end you would enter -2.

- Issue – Select from the dropdown box if this activity has an Issue. If no issue, select none. Note, when an activity has been labeled as an Issue here and the ‘Highlight Items With Issues’ is ‘Yes’ the entire row will automatically be highlighted yellow. Use this to quickly pinpoint areas that need additional attention.

- Activity Description – Brief description of activity to be performed. While it should be brief, you want enough information to be clear. Tip, use specific report names or file locations as a memory jogger in the description.

- Owner – Individual that owns this activity. In this case the owner is the person who is going to accomplish the activity.

- Progress – Keep track of progress by selecting the status of the activity. Select either Not Started, In Process, or Complete. Based on your selection, this cell will automatically change colors, except for Not Started which stays white. In Process = Orange. Complete = Green. This color coding makes it quick and easy to look over the month-end close checklist and gauge progress.

- Due Date – Date the Activity is due. This is a formula based on the Day column and Month-End date.

- Date Complete – Actual date activity is completed. Leave this cell blank until the activity has been marked complete.

- Comments – Enter comments relevant to activity. Tip, keep track of issues or ideas for improvement within the comments section.

The Footer – We’ve included a footer in this document. Both the file location and the page numbers are included in the footer. This is helpful so that when the month-end close checklist is printed its original location is identified making it easy to find again electronically. The page number is in the X of Y format, so if you have 2 pages of the close checklist and there actually 3 you can quickly tell. It will say page 2 of 3, so you’ll know you’re missing key information.

Month-End Close Best Practices

Processes – Implement well-defined processes. The processes should be understood by all team members and include contingency plans. What happens when something goes wrong or when someone isn’t there? Part of the process should be a month-end close checklist similar to the free one you found here.

Communication – this would include both accounting and non-accounting personnel. Ensure that all owners have an understanding of their role and expectations. The month-end close checklist includes a meeting activity (G-2) to go over key information. Be vocal about the process, distribute a closing calendar and keep lines of communication open. However, don’t wait for month-end to communicate. Keep the process open and active during the month. Distribute a contact list with names, titles, and contact information and encourage people to use this list proactively.

Templates – The use of templates standardizes processes and procedures. It makes them easier to complete, review and transition between team members. Implement templates in the journal entry process, the reconciliation process, the financial reporting process, the control narrative process, reminder emails (i.e., when emailing personnel regarding the due date for expense reports – use a template), etc.

Simplify – Try to keep things simple and straight-forward. Evaluate the activities being performed and the time it takes to perform those activities to ensure the appropriate value is being realized. Activities consuming a large amount of resource time may be an indicator of inefficiency or complexity that needs to be addressed. Keep track of errors and evaluate the root cause. Automate where possible. This will not only simplify the level of effort necessary but will also improve the accuracy of the related financial information. Lastly, combine activities where it makes sense. This will help reduce the amount of time being spent redundantly.

Planning – Identify tasks and activities that can be done before the end of the month. Certain tasks, such as the payroll accrual don’t need to be performed after the end of the month. Such calculations can be easily and accurately estimated prior to the end of the month. When reviewing tasks for simplification, be on the lookout for tasks that can be done in pieces. For example, if your company frequently disposes of and/or acquires fixed assets, establish weekly procedures to track and account for this activity. Another example is cash. Maybe this is a time-consuming process and should be done weekly so that only the last week of the month needs to be reconciled, and all other issues have previously been resolved. A weekly cash reconciliation process helps with the month-end close time, improves cash controls, and can be a part of a cash management strategy.

Post-mortem – Just as critical as the planning phase, is a post-mortem. How did the close go? What can be improved? What needs to change? We’ve included a post-mortem step (G-7) in our checklist so it becomes part of the process. Use the post-mortem to make changes to the checklist while the information is fresh on your mind. This evaluation should take place right after the financial package is published and distributed. Tip – use the checklist to identify metrics that can be measured against progress. For example, you can track:

- Number of issues encountered during the month

- Number of days from month-end to distribution of the financial package

- Tasks completed on time (Date Complete vs. Due Date)