The percentage of completion schedule calculates the amount of revenue to be recognized for long-term construction-type contracts. There are other acceptable methods of revenue recognition, but the cost-to-cost method used in this template is one of the more popular. The cost-to-cost method provides for proportional recognition of revenue to costs. For example, lets assume a project is going to cost the contractor $70. The contractor is going charge the end customer $100, and at the end of the year $35 of costs had been incurred. Using this method, the contractor would recognize $50 of revenue. The $50 is determined by dividing the $35 incurred by the total estimated cost of $70, which is 50%. Multiplying the 50% by the $100 contract value gives you the $50 recognized.

Percentage of Completion Template

System Requirements & Download

Percentage of Completion Download

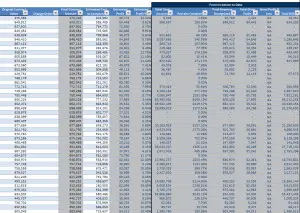

Download 152.50 KB 10104 downloadsEnter the job-specific information into all of the columns that are not shaded gray (gray columns include formulas). All formulas are unprotected and can be seen so you can evaluate them for yourself. Additionally, no part of this excel template is locked – you can add additional information and track as many individual aspects of a project as you see fit.

The “Entries” section shows the amount of Billings In Excess of Costs / Costs In Excess of Billings, CY Revenue Recognized, as well as the amount of Accrued Loss (if this is a loss job) that would be recognized based on the information input. The calculations are based on the cost to cost method of accounting (i.e., the percent complete is a function of total costs actually incurred as compared to total costs expected to be incurred in order to complete the project).

The information you need to complete this schedule is as follows:

- The original order value

- Total value of change orders

- Total estimated costs to complete the project

- Actual costs incurred on the project life to date – there are two columns to track costs, one for the current year (CY) costs and one for prior year (PY) costs; all costs incurred before the CY can be input into the PY column.

- Revenue recognized in the PY (and before if necessary – just like the PY costs)

- Total CY billings

- There is an “Other” column included as well if additional information needs to be tracked

Note this excel template is formatted to print out on 11×17 sized paper (due to the number of columns).

Resources for Percentage of Completion

There are several resources that will benefit individuals who are responsible for preparing a percentage of completion schedule. These resources are especially important if your schedule must be in compliance with Generally Accepted Accounting Principles (GAAP). Here are some ideas and helpful resources:

- The AICPA’s Construction Contractors – Audit and Accounting Guide – This guide summarizes new standards, guidance, and practices, and delivers “how-to” advice for handling audit and accounting issues common to construction contractors.

- Accounting Standards Codification 605-35 – The standards that are GAAP. You can establish a free account with the FASB and review the codification FASB.org.

- Search google.com, AICPA.org, or your local society of CPA’s for upcoming courses or self study courses.

- Seek the help of a professional – Sometimes its necessary to seek the help of a qualified professional to assist in the specifics of your circumstances. If your concern is proper accounting and reporting, ensure the professional carries the designation of CPA (Certified Public Accountant).