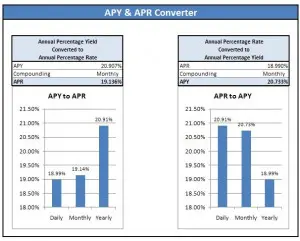

Annual Percentage Yield (APY) and Annual Percentage Rate (APR). This calculator converts from one to the other. Generally people want to convert from APY to APR or APR to APY in order to understand similar investments or loans, or in order to perform their own calculations.

APY & APR Converter

System Requirements & Download

APY & APR Converter Download

Download 56.00 KB 2079 downloadsNeed to know how to convert APR to APY, or how to convert APY to APR?

Use this APR to APY Converter to quickly convert from one to the other. The difference between APY and APR is simple. However, there’s no consistency between institutions as to which one is used. Because of this inconsistency it’s easy to get confused. APY includes compounding and APR does not. So, institutions that are trying to get you to invest your money generally report APY. Think Banks selling CD’s or promoting their money market account. They want the number to look big. Whereas institutions lending you money generally report APR. Think credit card companies. They want the number to look small.

Now for example, if you invest $10,000 into a money market account that has a 4% APY the APR is actually 3.93%. This assumes interest is compounded monthly. So, at end of the first month your account will be credited with $33 of interest (.0393/12*10,000). At the end of the second month, you’ll earn interest on the interest paid the previous month. Each month thereafter the interest will build, until after 12 months when the total interest earned will be $400. That’s where the 4% APY comes in. The yield is the total that you get, with compounding, based on the annual percentage rate.

Now you know. Use this APY & APR Converter to your advantage. Download the file and have a handy calculator to keep in your “back pocket.” The next time someone tries to confuse you with APY or APR, you’ll be ready.

See how we used this calculator to evaluate the return we were getting on our emergency fund, and came up with alternative investments to improve our return by 20%.