Need a European-style Black-Scholes calculator to compute the value of a Put Option or Call Option? Just interested in how the calculation works? Want something just to double check a calculation? Either way, this spreadsheet will help. All of the formulas can be read (and modified if you think that’s necessary).

Black-Scholes Model (European)

System Requirements & Download

Black-Scholes Download

Download 59.50 KB 8215 downloads- Market Price – Yahoo Finance

- Risk Free Rate – Federal Reserve

- Volatility – SpreadsheetShoppe.com, we’ve included another file below that has a volatility calculator included. If your looking for a volatility calculator by itself go here.

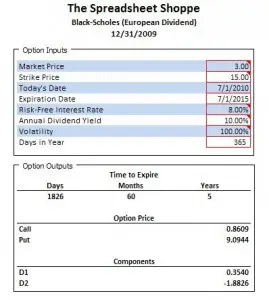

Enter information into the cells outlined in red. Option Outputs is all formula driven.

Template Summary

- Simple to use

- Easy to understand

- Notes included to help guide input completion

- Inputs and outputs are clearly defined

- No hidden calculations

- No macros

- Straight forward

Once the inputs are entered, both the call option and the put option are calculated. We’ve also shown the formulas for the primary parameters – d1 and d2. The time to expire is shown in Days, Months, and Years. This calculation is based on the Start Date and Expiration Date as well as the number of days in the year. Adjust as necessary. Note, be sure to delete the example information before beginning. Also, all items in the input section are required to be completed; therefore, if an item is zero, enter a “0” in that cell.

For those of you who want this Black-Scholes Model combined with the historical volatility also found on this site we’ve combined them for you in the link below.

Black-Scholes Model w Volatility Download

Download 3.40 MB 4351 downloads