Is your coffee habit really worth it? Maybe it’s not coffee. We all have little pleasures and people telling us what we should or should not be doing. You know what I’m talking about. Personal finance experts whose entire strategy is to get you to give up

Read more →Annual Percentage Yield (APY) and Annual Percentage Rate (APR). This calculator converts from one to the other. Generally people want to convert from APY to APR or APR to APY in order to understand similar investments or loans, or in order to perform their own calculations. APY

Read more →Figuring out how much you need to save for retirement can be a difficult task. Because of the uncertainties that exist it’s impossible to know exactly how much you’ll need to retire securely. However, don’t let those uncertainties deter you from proper planning. There are several things

Read more →An incremental purchase or sale of an investment can impact your average basis. The basis is your average cost of the original investment. For tax purposes, the method of computing the gain or loss on investments must be elected and consistently applied. This spreadsheet does not track

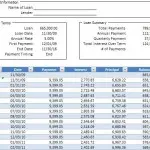

Read more →Enter the inputs for the loan, and a simple amortization schedule is produced. This schedule is designed using an Excel table, and includes a dynamic print range so only the applicable information will print. Simple Loan Amortization Schedule

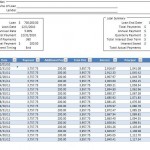

Read more →This schedule is very similar to the simple loan amortization schedule; however, it allows for additional payments to be added. Based on these additional payments, it calculates the amount of interest saved. Can’t make the same additional monthly payment? Do you have a little extra to pay

Read more →Analyze and evaluate accounts receivable over a 5 year period with this tool. All information can be reviewed graphically over time to provide additional context. Eight key ratios are calculated off of a few inputs. These ratios include Days Sales in Trade AR, AR Turnover, and Bad

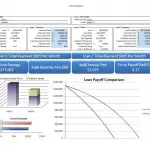

Read more →Compare two loans instantly. Thinking about refinancing? Want to see the impact of making additional payments on your current loan? Looking to buy up? Use this loan amortization comparison spreadsheet to instantly draw a comparison between one loan and another. Three tabs are included. An Inputs tab

Read more →How much money do you need in your emergency fund? The answer is, no one knows. There are a lot of variables to consider: how risk averse you are, number of incomes, extent to which your expenses are fixed vs. variable, amount of income earned from investments,

Read more →Do you know how much you need to save for your child’s college education? Use this college savings calculator to estimate the total costs of college and the required yearly and monthly savings goals that will get you there. Of course, it’s impossible to know what the

Read more →