Do you know how much you need to save for your child’s college education? Use this college savings calculator to estimate the total costs of college and the required yearly and monthly savings goals that will get you there. Of course, it’s impossible to know what the actual costs are going to be until college begins. Inflation, scholarships, and even the costs of the specific school chosen (in state or out of state) can only be estimated. Each year, as college gets closer, these estimates can be revised. However, starting to save enough too late may mean that it will be impossible to recover before college begins.

College Savings Calculator

System Requirements & Download

College Savings Calculator Download

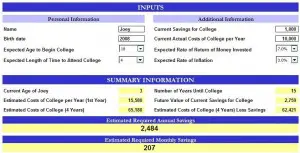

Download 61.50 KB 2718 downloadsThere are a total of 8 inputs necessary for this college costs calculator which will estimate the total amount of monthly (and annual) savings required to meet the costs of college at some point in the future. It’s important to remember that this calculator is really just a good tool to estimate how much you should be saving. Due to the fluctuations that actually take place in both financial markets as well as the costs of higher education, there can be no guarantee that you’ll have enough money to pay for college just because the “required savings” are achieved.

Just like saving for retirement, or any other goal, it’s important to periodically check progress. The further out the goal is, the greater the need to perform this calculation regularly. Ideally, this calculation should be performed annually. Calculating the amount of college savings that is required on an annual basis, will help mitigate some of the fluctuations noted above.

Here are some other key points to keep in mind when performing this calculation:

- Use a specific college, or an average of 2 or 3 colleges, in order to input the “Current Actual Costs of College per Year” – as an alternative you can use the average cost of college reported. The College Board is an excellent resource to find information on the cost of tuition. One thing to keep in mind is that the “cost of college” is much more than tuition. Savingsforcollege.com has a great “tutorial” on the real costs of college.

- Because this calculator is a simple demonstration of the time value of money, the following hold true: 1) the earlier you start saving and the greater your expected return the less you’ll be “required” to save annually; and 2) the higher the cost of tuition and inflation the more you’ll be “required” to save.

Saving for college is a daunting task, and many financial professionals recommend starting as early as possible. Balancing finances and saving goals seems to only get more complex with time; however, doing your homework early and planning/tracking incremental goals will significantly increase your chances of success.

Be sure to check out our personal budget template, which will help keep your financial goals on track.

Note, we make no guarantees surrounding the appropriateness of the calculations included within this calculator with regard to your specific circumstances, the inputs you choose to use, how you choose to use this calculator or the the appropriateness of the conclusions you might come to as a result of using this calculator.