How much money do you need in your emergency fund? The answer is, no one knows. There are a lot of variables to consider: how risk averse you are, number of incomes, extent to which your expenses are fixed vs. variable, amount of income earned from investments, stability of your employer/industry, and the list goes on. I’m a believer in a large emergency fund. I feel it’s important that once you have a large emergency fund, you maximize return without unnecessary risk. This emergency fund analysis helps evaluate the impact of your emergency fund and maximize its return.

Emergency Fund Analysis

System Requirements & Download

Emergency Fund Analysis Download

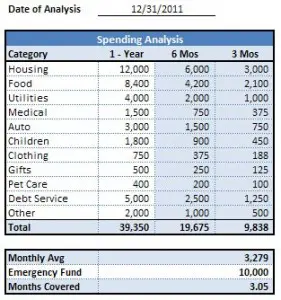

Download 115.00 KB 3116 downloadsThe first step in building an emergency fund is to know what your typical monthly expenses are and decide how many months you need to put away for that unexpected emergency. This template includes a spending analysis that allows you to evaluate your expenses by major category then enter the amount of your fund to see how many months are covered (see picture to the left).

Once you have a sizable emergency fund, you’ll want to take the time to ensure that you maximize its returns without opening yourself up to unnecessary risk. The picture above shows the Emergency Fund Analysis included in this template that will allow you to do just that.

[wpdm_file id=1 title=”true” template=”facebook ” ]

Let’s Get Personal

Do you have an emergency fund established? Maybe you don’t because you’re not sure the best way to begin. Or maybe you have a well established emergency fund and want to know if you’re maximizing the returns without introducing unnecessary risk. Find out how to get started, what to do once established, see how we’ve allocated our emergency fund and what type of risk/reward we’re getting.

My Story

Several years ago, my wife and I decided that we were “financially flabby” – a conclusion we came to after reading The Total Money Makeover, by Dave Ramsey. At that time we had just recently purchased a new car, we used credit cards for all of our spending needs, and thought so long as we were putting “some” away for retirement each month we were ahead of the game. We were doing so much, so wrong!

As we began to educate ourselves, we realized that buying a brand new car probably wasn’t the best idea. Although we paid it off each month, our credit card spending led to very loose spending. By the end of the year (or month for that matter), we really couldn’t figure out where all of our money had gone. We also realized that we could be saving so much more if we simply cleaned up our spending habits. Probably more importantly, we figured out that we really didn’t have an emergency fund in place should something unexpected happen. Knowing it was time for a change, we immediately started keeping a personal budget and began working on establishing an emergency fund (using Dave Ramsey’s The Seven Baby Steps). Here are the first 3 baby steps:

$1,000 to start an emergency fund

Pay off all debt

Establish an emergency fund equal to 3 – 6 months of expenses

Luckily, because we were in the habit of paying off our credit cards each month, the only real debt we had was the new car. By keeping a monthly budget, cutting through our monthly cash outflow, and sticking with a plan we paid the car off in about 3 months. Yes, three months and baaammm – no debt, the car was now our asset! The Dave Ramsey program is all about applying focus – focus all of your energy and resources on individual tasks using the momentum from each task accomplished to tackle the next. This is a fantastic way to make progress because you see results very quickly. Small results build and lead to big results. Admittedly, it’s a little scary to make the necessary changes at first because it requires you to change things that you’ve become comfortable with and probably enjoy. We eliminated our credit cards (cut them up and closed the accounts), stopped saving money in our 401k (very scary for me), and slashed into the luxury items to which we had grown so accustomed. All of these cuts were necessary for us to establish the emergency fund. Once the fund is established, a lot of these things can go back to normal.

Our goal was to establish an emergency fund equal to 3 months of normal living expenses. It took us almost 6 months to get there, and at that point we could loosen back up some on our spending and again start funding our retirement. In a little under 9 months, we were able to abolish all debt and establish the basic emergency fund. We did this 1 year after our first child arrived, and our household income had been cut by 30% as a result of my wife transitioning from working full time to part time. It was tough, but it felt great!

Throughout the rest of this post, I’ll discuss some of the key elements of an emergency fund.

Why Have an Emergency Fund?

Having an emergency fund is absolutely necessary, especially in today’s economy. If the primary earner in your household is temporarily out of work, temporarily may mean more than just a few weeks. What’s your plan? How will you deal with such a significant unexpected event? I, personally, know people who have spent several months looking for work before something finally came through, and these individuals were well qualified for the positions they were seeking.

An emergency fund allows you to get through those tough times without driving your family into substantial debt. It allows you to focus your energy on dealing with the unexpected event as opposed to worrying about finances during the unexpected event. Examples of the unexpected events are loss of employment, medical expenses, automotive repairs, or any other life or family emergency that may come at you from nowhere.

How to Build an Emergency Fund

After reading my story, it’s probably not going to come as any surprise that I’m going to suggest that you build an emergency fund aggressively. Generally, people like to have 3 – 6 months of living expenses (this is not 3 – 6 months of income). That’s easy to say, but do you know what 3 – 6 months of your living expenses truly are? If you don’t, and you haven’t been keeping any type of budget, you might have to estimate. You can use our Spending Analysis spreadsheet (included in the download above) to help, or just sit down with pen and paper and crunch some numbers. When you first start an emergency fund, put everything else on hold. Stop spending needlessly (i.e., Starbucks, going out to lunch, etc) and put a hold on saving for retirement and kids college. This will help in 2 ways: 1) giving up on all of these things that you enjoy, and may even feel that you need, will keep you motivated and focused; and 2) refocusing those financial resources will help build it fast…you don’t want this process to take 2 – 3 years, it should take just a few months. Apply this focus, at a minimum, until you have 3 solid months in emergency cash. Here are a few things to consider when figuring out the right amount to set aside:

- How many income earners does your household have? Families with only one earner may want to have more set aside.

- How many people are dependent on you or your family? Are there more people than just the people living in your house that depend on you – maybe older parents, other family members?

- How stable is the industry in which you and/or your spouse are employed?

- How do your fixed expenses compare to your variable expenses? How much control do you have over your variable expenses?

- How much income do you earn outside of your day to day job (i.e., passive income, dividends, interest, etc)? How regular is this income and how stable?

- What is your individual risk tolerance? The more you have set aside in an emergency fund, the more security you’ll have; however, this has to be balanced with your other investment decisions.

For my family of 4, we have 1 income earner in an industry and economy that is relatively stable. Expenses are well managed and we do have a fair amount of control over our variable expenses; however, we have some sizable fixed expenses. Overall we have a moderate risk tolerance. For our family we’ve decided that we would like to have 8 – 10 months of expenses in an emergency fund (primarily because we have just one earner). This is higher than what is generally discussed, but it’s right for our circumstances.

How to Invest an Emergency Fund

Once you have a sizable emergency fund, you’ll want to consider what type of return you’re getting without introducing unnecessary risk and/or restrictions. Here are the most common types of accounts for emergency fund money:

- Savings Account / Money Market Account – low interest, but very accessible and secure

- Rewards Checking – typically has minimum standards to achieve the “rewards” (i.e., direct deposit, automatic bill pay, minimum number of debt card transactions, etc.); you have to be disciplined such that you won’t miss the minimums and won’t tap into the emergency fund. The pros are that it’s very accessible, and I’ve found these currently pay better interest than the most alternatives.

- Certificate of Deposits (CD’s) – typically have terms (i.e., 1 year, 5 year, etc), which make them less liquid and generally there are penalties for early withdrawal; CD’s are still a safe investment and should pay better interest than money markets in the current market.

Be sure to check your local banks and credit unions for their rates as well. For example while my bank doesn’t currently offer the best CD rates I can find, their rewards checking pays 4.10% APY, which is about 2 – 3% better than most of the other options currently available. The key is to run searches online, talk to friends and family, and go with something local or a name with which you’re familiar.

How My Emergency Fund is Invested

I recently just went through a process to evaluate the efficiency of how our emergency fund is invested (currently we have 7.5 months in emergency cash so we’ll need to add a little to it in order to get to our comfort zone). When we put our money into the emergency accounts – we “forget” about it and with time your expenses seem to grow and better investment alternatives may be available. It’s a good idea to give your emergency fund a once over annually.

This year, what I found is that with a few minor changes, we could be earning about 20% more in interest (just in the first year of the changes) without changing the basic risks or liquidity much.

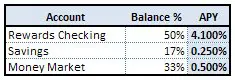

Original

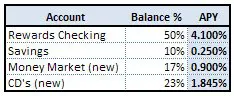

Adjusted

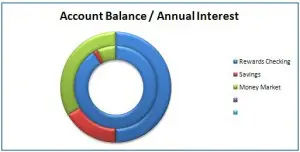

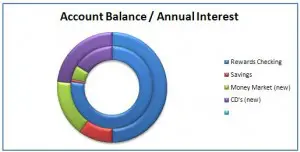

In the graphs below the outside ring represents the amount invested and the inside ring represents the return. So you can see that the rewards checking (blue) represents half of our fund, but a much more substantial portion of our annual interest.

Just 2 simple changes were made: 1) We got a better money market account; it pays almost twice the interest as the one we previously had; and 2) Moved some of the money invested in Savings and the Money Market into CD’s. The CD’s pay a much higher rate than either Savings or Money Market, but they also come with small penalties for early withdrawal. We decided to incorporate CD’s because we still have more than 75% of our emergency fund in very liquid, easily accessible accounts and the penalty for withdrawal is not severe should we need to access the money invested in CD’s.