Figuring out how much you need to save for retirement can be a difficult task. Because of the uncertainties that exist it’s impossible to know exactly how much you’ll need to retire securely. However, don’t let those uncertainties deter you from proper planning. There are several things you can do to give yourself the best chances of success. One of those, is estimating how much you’ll need in retirement with a retirement calculator.

Retirement Calculator

System Requirements & Download

Retirement Calculator Download

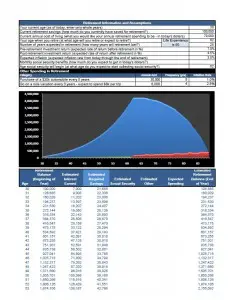

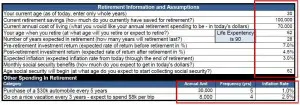

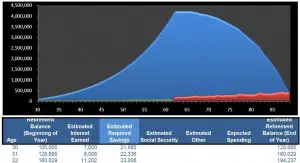

Download 112.50 KB 8326 downloadsThis retirement calculator is designed to help you plan for retirement. Download the spreadsheet, plug in your personal information and see your estimated “required savings.” Now you can adjust the inputs to see how your retirement could be impacted. Here’s how it works, in 2 steps:

Retirement Calculator Step 1

Retirement Calculator Step 2

Other Useful Information

- Use this retirement calculator to estimate how much your current retirement savings will be worth in the future. To do this just input your age, current retirement savings, age at retirement, years in retirement, and the pre- and post- rates of return. Leaving all other cells blank you can see the future value of your current savings.

- Check your life expectancy. After you enter your retirement age and years in retirement, your life expectancy will calculate. Because how long you live has a significant impact on your required savings, you’ll want to be sure you have a reasonable life expectancy.

- Apply individual inflation rates to big purchases. Maybe you’ll have some large expenses that you don’t expect to incur annually, input those in the Other Spending section. Apply individual rates of inflation to each purchase.

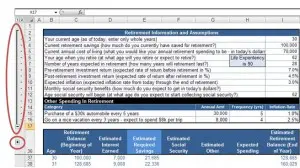

- Expand or collapse the inputs and/or the graph. In the picture below, you can see that the graph has been collapsed, use the grouping buttons (highlighted by the red circles) to expand or collapse the information you don’t need.