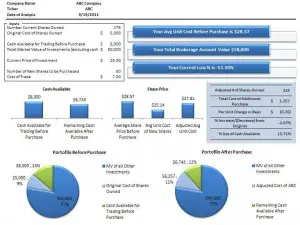

An incremental purchase or sale of an investment can impact your average basis. The basis is your average cost of the original investment. For tax purposes, the method of computing the gain or loss on investments must be elected and consistently applied. This spreadsheet does not track or evaluate the tax consequences of transactions. What it does is a) evaluate the impact to the average share price based on a additional investment and b) calculate the percentage of a new investment within your portfolio. This share basis analysis will help to understand the overall impact of a single purchase on your gain/loss position as well as diversification.

Share Basis Analysis

System Requirements & Download

Share Basis Analysis Download

Download 88.00 KB 3675 downloadsThis spreadsheet utilizes 7 inputs to generate critical information used to evaluate an additional investment into a position in your current investment portfolio. Quickly find answers to questions such as:

- How will my adjusted per share basis be impacted if I made an additional purchase?

- What percentage of my portfolio does this investment represent before purchasing additional shares?

- What percentage of my portfolio does this investment represent after purchasing additional shares?

- How much cash will I use in this additional purchase?

- What is my current gain (or loss) in this investment?

Quickly change the inputs to see the impact to your portfolio. You can also make copies of this analysis and compare different options.

This spreadsheet won’t tell you if your investment decisions are good decisions. It will provide you with information that may help to guide your decisions. For example, assume you want to keep at least 5% of your portfolio in cash, that you don’t want any investment to represent more than 10% of your portfolio, and you also want to know what your adjusted basis would be in a specific stock after an additional purchase. Without this share basis analysis template, these 3 simple calculations would have to be run each time you tweaked one of the inputs. By using this spreadsheet, you will not only be able to see the values associated with each of these assumptions, but it will also provide the associated percentages as well as a graphical representation of each. The aspects that are important to you should be easily seen and made to stand out through the dashboard feature.

Dashboards are popular because of how they allow users of information to quickly digest that information, plus they look pretty cool. The dashboard included within this analysis was designed to highlight the information we think is critical. Download this template to give it a go the next time you’re making investment decisions – if nothing else it should at least be aesthetically pleasing.