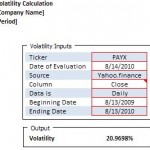

This volatility calculator can be used to establish the volatility of a publicly traded stock based on the inputs you provide. Use this spreadsheet to price options. The historical prices are input on one tab (the download contains an example from yahoo.finance). Then complete the remaining inputs

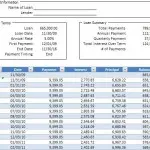

Read more →Enter the inputs for the loan, and a simple amortization schedule is produced. This schedule is designed using an Excel table, and includes a dynamic print range so only the applicable information will print. Simple Loan Amortization Schedule

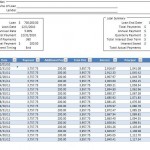

Read more →This schedule is very similar to the simple loan amortization schedule; however, it allows for additional payments to be added. Based on these additional payments, it calculates the amount of interest saved. Can’t make the same additional monthly payment? Do you have a little extra to pay

Read more →Analyze and evaluate accounts receivable over a 5 year period with this tool. All information can be reviewed graphically over time to provide additional context. Eight key ratios are calculated off of a few inputs. These ratios include Days Sales in Trade AR, AR Turnover, and Bad

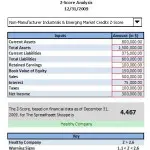

Read more →The Z-Score, also known as the insolvency predictor, can be used to determine the probability of bankruptcy within a period of two years. Simply select the type of company you’re evaluating and complete the inputs. Altman Z-Score Calculator Z-Score History: Altman’s Z-Score originally surfaced in 1968 and

Read more →Need a simple calculator to establish the weighted average cost of capital (WACC)? Additional descriptions and useful links are included within this spreadsheet to assist in what can be a complex calculation. Weighted Average Cost of Capital (WACC)

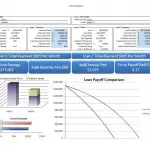

Read more →Compare two loans instantly. Thinking about refinancing? Want to see the impact of making additional payments on your current loan? Looking to buy up? Use this loan amortization comparison spreadsheet to instantly draw a comparison between one loan and another. Three tabs are included. An Inputs tab

Read more →Complete the inputs (e.g., fixed costs and variable costs) associated with the unit and select the time frame over which you want to evaluate your breakeven point. The output generated includes contribution margin analysis, variance analysis, as well as other unit cost information. It is designed to

Read more →How much money do you need in your emergency fund? The answer is, no one knows. There are a lot of variables to consider: how risk averse you are, number of incomes, extent to which your expenses are fixed vs. variable, amount of income earned from investments,

Read more →Do you know how much you need to save for your child’s college education? Use this college savings calculator to estimate the total costs of college and the required yearly and monthly savings goals that will get you there. Of course, it’s impossible to know what the

Read more →