How do I keep track of when to follow-up on open invoices? Or a more simple way to put it, ‘How do I manage accounts receivable’? This was a question from an accounts receivable manager who was trying to monitor contact with multiple customers. The time between when

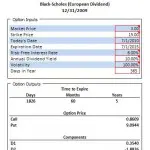

Read more →Need a European-style Black-Scholes calculator to compute the value of a Put Option or Call Option? Just interested in how the calculation works? Want something just to double check a calculation? Either way, this spreadsheet will help. All of the formulas can be read (and modified if you

Read more →Download this bank reconciliation template and incorporate it into your month-end close process. A bank reconciliation is a check between your records (or your company’s) and the banks records. It is a necessary control for every cash account. Going through the bank reconciliation process can identify errors and

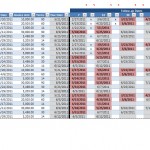

Read more →Every business should leverage an accounts receivable aging to manage balances outstanding. However, not every business has the need for an expensive accounts receivable ledger or system. This accounts receivable aging is an excel template that makes it easy to age invoices. It’s also been designed to

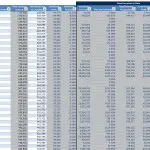

Read more →The percentage of completion schedule calculates the amount of revenue to be recognized for long-term construction-type contracts. There are other acceptable methods of revenue recognition, but the cost-to-cost method used in this template is one of the more popular. The cost-to-cost method provides for proportional recognition of revenue

Read more →A 3 year comparison of EBITDA (Earnings Before Interest, Taxes, Depreciation and Amortization) and several financial leverage ratios (EBITDA to P&I Payments, Debt Ratio, Debt to Equity, and Interest Coverage), are all shown graphically with a few simple inputs. The analysis will print to one page. EBITDA

Read more →The preparation of the statement of cash flows (indirect method) can be a time-consuming task. Schedules become messy and cluttered as the schedule grows in length or complex transactions are introduced. This clutter oftentimes leads to unnecessary time, wasted energy, and the occasional error. The purpose of this template is to help those

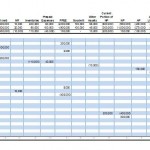

Read more →The proof of cash template is also known as the four-column bank reconciliation. It is a powerhouse reconciliation generally used to detect fraud and highlight errors. There are several ways to perform a proof of cash, and we’ve attempted to take as much complexity out of the

Read more →Looking for a lease commitment template? Commonly accountants are required to report a 5 year schedule of commitments. Such schedules are susceptible to error as these calculations are preformed manually and summarized information is entered or start and end dates are off. This template simplifies this process

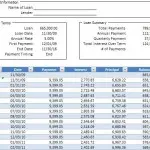

Read more →Enter the inputs for the loan, and a simple amortization schedule is produced. This schedule is designed using an Excel table, and includes a dynamic print range so only the applicable information will print. Simple Loan Amortization Schedule

Read more →