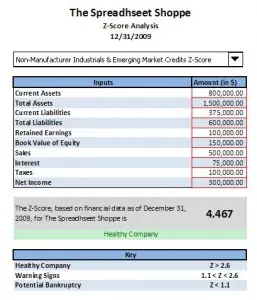

The Z-Score, also known as the insolvency predictor, can be used to determine the probability of bankruptcy within a period of two years. Simply select the type of company you’re evaluating and complete the inputs.

Altman Z-Score Calculator

System Requirements & Download

Z-Score Download

Download 61.50 KB 4660 downloads- Option to select industry

- Zone definitions

- Example data

- No macros, just a simple calculator

Z-Score History:

Altman’s Z-Score originally surfaced in 1968 and was created by Edward Altman in order to determine the likelihood that a business would enter into bankruptcy within a period of two years. The Z-Score is reportedly 80 – 90% accurate in determining bankruptcies. A false positive (i.e., the Z-Score says bankruptcy is likely when in fact it is not) occurs approximately 10 – 20% of the time.

The Z-Score is a formula consisting of four to five weighted financial ratios (incorporating information from both the balance sheet and income statement). There are currently several formulas to compute a z-score. Each formula is designed for a particular type of company/organization (i.e., Public Companies, Private Companies, and Non-Manufacturer Industrials & Emerging Markets). The result can be evaluated based on established “Zones.” These “Zones” are broken up into 3 distinct groups: a) Healthy Company, b) Warning Signs, and c) Potential Bankruptcy.

Things to watch out for:

The Z-Score model is industry-specific. It’s critical that the user understand the model being used relative to the company being evaluated.

- False positives do happen.

- Financial firms should not be evaluated with the Z-Score.

- Know and understand the ratios being used in the Z-Score. This will aid in any additional evaluation and assist in understanding trends over a period of time.

- The output quality is dependent upon the input quality. Be aware of potential off balance sheet arrangements, accounting inaccuracies, etc.

Didn’t find what you were looking for?

You read more about the Altman Z-Score at Wikipedia or at the Stern School of Business.